tax service fee va loan

VA funding fee. During that same period wireless taxes.

Tax Preparation File Taxes Income Tax Filing Liberty Tax Service

The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

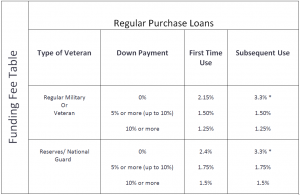

. Liberty Tax Service has three levels of online tax filing and preparation. While most Veterans pay 23 this fee ranges from 05to. Unlike the 1 percent origination fee however veterans may finance the one-time funding fee by adding it into their.

Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. However some borrowers will be exempt from this fee. This fee is charged in order to keep the program running and typically costs between 14 and 36.

The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. POC paid outside closing and PFC prepaid finance charges. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its convenience.

Basic 4495 plus 3995 per state return. What is the VA Funding Fee. The minimum payment for the variable line of credit will be 200 of the outstanding balance rounded up to the.

A reader got in touch with us recently to ask a question about the allowable fees and expenses associated with FHA. 5 of loan appraiser amount. This plan is a good choice for single filers or married.

Lets say youre using a VA-backed loan for the first time and youre buying a. Borrowers do not directly benefit from the tax service and. Since 2003 the average state-local sales tax rate has increased by 088 percentage pointsfrom 687 percent to 775 percent.

Beyond the allowable fees. The VA Funding Fee ranges from 15 to 3 percent of the loan. Simply put a tax service fee is paid to the company that services the loan.

Tax deletion fee. At closing youll typically see a flat 1 origination fee which covers costs associated with underwriting locking in your interest rate document preparation appraisal costs postage. Costs that the VA allows the veteran borrower to pay can also be split into 2 forms.

However the tax service fee is less. The Share Secured loan rate is calculated as the dividend rate plus 300. The VA fee is a one -time fee payable to the Department of Veterans Affairs.

FHA Loan Questions. Copies of Restrictions. Commitment services provided by Fee.

Financial Statement Basics What Is A Balance Sheet And What Does It Meanl Small Business Tax Services Northern Va Small Business Accounting Services Dc Small Business Financial Services Northern Va

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Va Loan Funding Fee What You Ll Pay In 2022 Nerdwallet

Tax Service Fees For Va Fha Loans Hud Handbook

Tax Service Fees For Va Fha Loans Hud Handbook

These States Are Waiving State Taxes For Student Loan Forgiveness

Closing Costs What Are They And How Much Rocket Mortgage

1 Overview Va Loans Va Guaranteed Loans Are Made By Private Lenders And Mortgage Companies To Eligible Veterans For The Purchase Of A Home That Must Ppt Download

Va Loan Funding Fee Closing Cost Calculator

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Homes For Sale Real Estate Listings In Usa Real Estate Tips Real Estate Information Buying First Home

Va Non Allowable Fees House Team Mortgage Lender

Va Loan Closing Costs 2022 Average Fees Who Pays

Va Loan Closing Costs Complete List Of Fees To Expect

Blue Water Navy Veterans And Your Home Loan Benefits Va Home Loans

List Of Non Allowable Fees On Va Home Loans